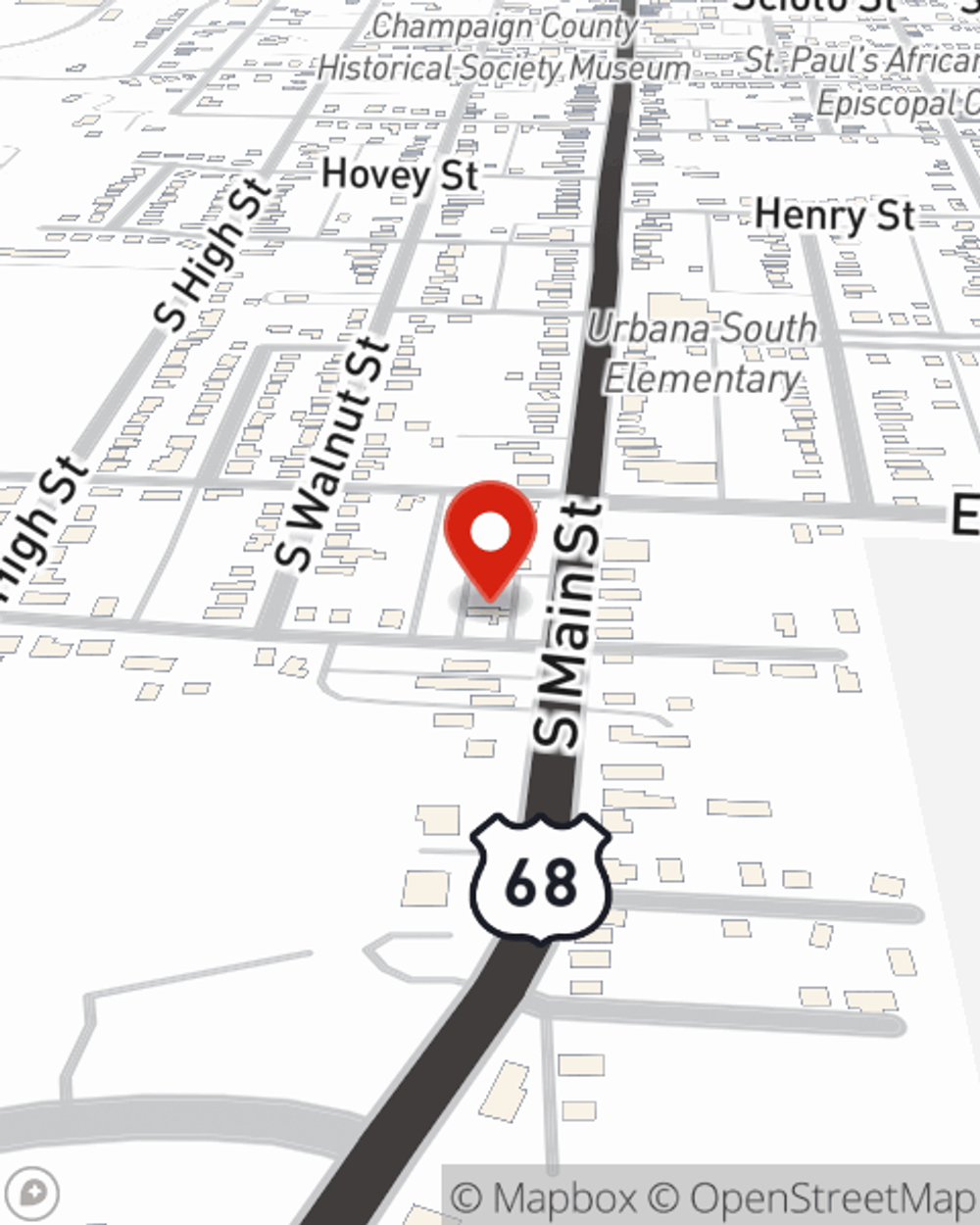

Life Insurance in and around Urbana

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

One of the greatest ways you can protect your partner is by taking the steps to be prepared. As uneasy as pondering this may make you feel, it's a good idea to make sure you have life insurance to prepare for the unexpected.

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

State Farm Can Help You Rest Easy

Having the right life insurance coverage can help loss be a bit less complicated for your family and give time to recover. It can also help cover bills and other expenses like car payments, retirement contributions and ongoing expenses.

Don’t let the unknown about your future keep you up at night. Contact State Farm Agent Erin Patton today and learn more about the advantages of State Farm life insurance.

Have More Questions About Life Insurance?

Call Erin at (937) 652-2463 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Why go paperless and engage digitally?

Why go paperless and engage digitally?

Customers are moving more towards receiving communications digitally. We'll explain what that could mean to you.

Erin Patton

State Farm® Insurance AgentSimple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Why go paperless and engage digitally?

Why go paperless and engage digitally?

Customers are moving more towards receiving communications digitally. We'll explain what that could mean to you.